Am I responsible for these fees?

I'm looking at picking up a car at a dealership

through carguru

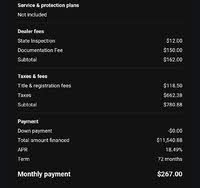

When I look at it, it says title and registration 118

and taxes 662

Subtotal being 780

Do i have to pay 780 to carguru? I had put down $0

down as I didn't have 1k to put down at the time. I

want to go pick up the new car tomorrow but if I

have to pay the 780 I gotta wait til I get paid from

my job

3 Answers

These are the fees you pay the Dealer. Cargurus doesn't sell anything. However, what I'm hearing is you are not in a position to buy this vehicle right now. If you're short on cash right now, taking on a car payment will not help your situation! The interest rate is horrible and how old is this vehicle that you'll be financing for the next 6 years? Personally I will never finance a vehicle, even a brand new one, for 6 years! Think this through before you start signing paperwork! Buy with your head, not your heart! You know what you can afford much better than someone who is looking to sell you something and make a profit! Jim

I'm only short now because my paycheck was lower due to my current car not being drivable. Making payments is no issue, I just need a running vehicle

I see. I would still caution you about financing an older vehicle for such a long time. As vehicles age repairs will be needed. Think about how old the vehicle will be when it's paid for. Will you be able to get at least a few years out of it, after it's paid for, before the repair bills start coming? Having a few repairs after the vehicle is paid for is one thing. But having repair bills and car payments, together, is another. I've been down that road and it's not fun! Trading in the vehicle before it's paid for is an option, but not a good one. The money you owe on that vehicle is added to the new loan. So you're paying for two vehicles, one of which you no longer have. I would also try to get a better interest rate. I know rates are high right now but 18.49 percent is excessive, in my opinion. Perhaps another lender or a cosigner would bring the interest rate down to a more reasonable rate. This way you could probably pay off the vehicle sooner. The Dealer might not like it because they usually make money on the loan too. But too bad, we're looking out for your best interests, not theirs! Jim